Our Winter Portfolios: Still profitable and beating the benchmark

9th March 2018 16:44

by Lee Wild from interactive investor

Share on

During a fantastic December and first half of January, equity markets were making record highs for fun. Then sentiment turned on a dime as traders began to factor in rising inflation and higher interest rates, causing hard won gains to disappear in a flash.

How our Winter Portfolios keep beating the market

February is typically a good month for stocks - the four-best month of the year, according to the Stock Market Almanac - so a 3.8% decline this time was a shock. However, our pair of winter portfolios not only remain in the money, but are also thrashing the benchmark index. Add in dividends earned, and the margin of outperformance is greater still.

March is, historically, a volatile month for equities, but sentiment typically improves in the final month of our seasonal strategy - April is statistically the second-best month of the year, returning on average 2.1%. Given most of our portfolio stocks are high beta, they should outperform in rising markets. Confidence is high!

Remember, statistics form the basis of both interactive investor's winter portfolios. Historic data proves that equity markets typically outperform over the six winter months from November to April. With help from stockmarket Almanac author and mathematician Stephen Eckett we identified the stocks with the best track record of returns over the past 10 winters.

Our so-called Consistent Winter Portfolio contains the five most reliable companies of the past decade - each has risen at least 90% of the time. To make our Aggressive Winter Portfolio, stocks must have a 70% success rate over the winter months.

Our reliable basket of shares has netted an average annual profit of 18% over the past 10 years versus just 3.5% for the FTSE 350 index. There's more risk in the aggressive portfolio, but average annual profit here has been 32%, almost 10 times the benchmark index.

Darkest month

The had its worst month in two years during February, losing over 450 points in the first nine days. Rising US Treasury yields were to blame, triggered by fears that rising inflation could cause a more aggressive rate tightening cycle and endanger global economic growth.

It appeared mid-month that traders had acclimatised to higher bond yields, higher inflation and another round of hikes in global interest rates. Indeed, London registered its biggest weekly increase since December 2016.

However, the blue-chip index then found itself lodged firmly within a 100-point range between 7,200 and 7,300 for the entire second half of the month.

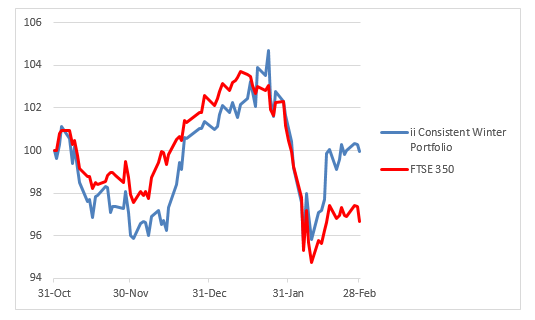

The Consistent Winter Portfolio ended the month down just 1%, which compares favourably with a FTSE 350 benchmark index down 3.8%. The Aggressive Winter Portfolio fell 4.4% in February, rocked by the collapse of takeover talks at constituent .

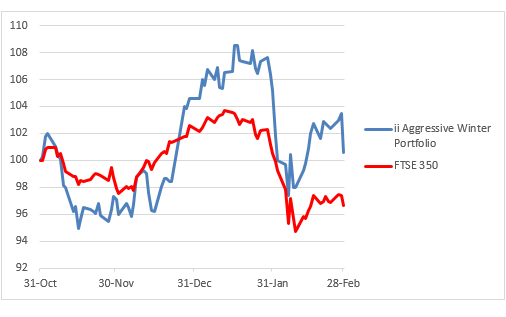

However, four months into the six-month strategy and the consistent basket of shares is flat and the aggressive portfolio is up 0.6%. Not spectacular, but impressive when compared to a 3.3% decline for the FTSE 350.

Aggressive Winter Portfolio

The interactive investor Aggressive Winter Portfolio had enjoyed a stunning few weeks during which it was returning over 8% - twice as much as the benchmark index. However, it was not immune from the correction and the portfolio underperformed the market in Feb.

High street fashion chain proved popular last month, adding 4.7% to take it's four-month share price gain to 7%. Equipment rental giant ended the period in positive territory, too, and is up 9% for the strategy so far amid buying ahead of this week's strong third-quarter results.

The other three constituents all fell. High-yielding housebuilder lost a modest 2.4% as its full-year results were peppered with cautious comment. Pre-tax profit fell 5.8% following a £130 million provision following a leasehold review, and TW's margin target "remains a challenging one".

But the real damage this month was done by workspace provider IWG and builders' merchant . Both ended the month down around 12%, the former due to a potential buyer of IWG calling off bid talks at the beginning of February, and the latter following weak full-year profit on the final day of the month. A weak pound and higher commodity prices are blamed.

It's worth remembering that, while a takeover is off the cards for now, IWG is still the aggressive portfolio's best performer, up 9%.

Consistent Winter Portfolio

FTSE 100-listed speciality chemicals firm is one of the most reliable stocks around in terms of seasonal share price performance. It's posted gains every winter for at least the past 13 years, which explains its position in our consistent portfolio.

In February, it rose more than 3% on the back of a 14% increase in pre-tax profit for 2017 on revenue up 10%. Chief executive Steve Foots remains bullish and the final dividend is up 11.5%.

was top performer, though, up 4.3% after an encouraging AGM and first-quarter trading update, but the caterer is still down 6.5% this winter; Croda is up over 10%.

Star performer - it's up 12.6% this winter - lost a fraction last month. Full-year results were good enough, as the hotelier reported its highest organic rooms growth since 2009.

Like the consistent portfolio, there were a couple of stinkers. Heat treatment specialist Bodycote stumbled in the run up to annual results in March, losing 4.6%, although it has since bounced back.

Irish building materials firm was the villain of the piece, however, slumping 8% ahead of its own full-year figures on 1 March, which weren’t bad after all.

Stephen Eckett

Stephen Eckett started his career with Baring Securities and then later worked for Bankers Trust and SG Warburg, during which time he worked in London, Hong Kong and Tokyo. After settling in France, he co-founded Harriman House which has become a leading independent publisher of financial books in the UK. He also writes books on finance including, most recently, the Harriman Stock Market Almanac.

-----------------------------------------------------------------------------------------------------------------------------------------------

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.