Preference shares safer than ordinary dividends

16th May 2013 16:50

by Nick Louth from interactive investor

Share on

It is getting pretty hard to find reliable income these days, but one investment still offers a high and stable payout that is safer than the income provided by an ordinary dividend: preference shares.

Preference shares are a hybrid of ordinary shares and corporate bonds. They offer solid income returns and relative safety, making them a worthwhile home for investors seeking inflation-beating income with little risk of a missed payment or default.

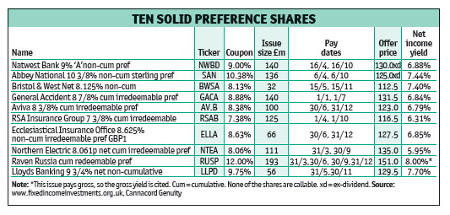

Preference share prices have risen significantly over the past two years and by about 15-20% in the past year. However, plenty of decent net yields of about 6-7% can still be found.

The dilemma for investors is whether to opt for lower but rising dividends in growth shares or utilities, or higher but static preference share yields. However, clearly, there is an argument for settling for a bit of both.

One crucial advantage of preference shares is that income from this piece of the fixed-income market will beat the current rate of inflation. By contrast, some yields on gilts and corporate bonds are negative in real terms and will sap your savings like a constantly dripping tap, especially now bond price falls look likely.

Preserving income

The biggest problem, though, is that only a minority of issues are liquid enough to access. Tiny issues such as Fishguard & Rosslare Railways & Harbours and are each valued at less than £1 million. Of the 85 issues listed on the London stock exchange, only a quarter are big enough and have sufficiently narrow spreads to be of interest. In fact, it is the spreads as much as anything that make most preference shares buy-and-hold investments, pumping out regular income to invest elsewhere.

There is a lack of diversity too. Historically, many of the biggest preference share issues were in banks and insurers.

However, the former were mauled in the banking crisis while the solvency of the latter has come under scrutiny in the light of the eurozone debt crisis.

A group of shareholders recently launched a £3.5 billion class action against , so it is clear that banks are not out of the woods yet. Yet for all that, the worst solvency worries have not, so far, proved justified. Last year RBS started paying dividends on the preference shares suspended as a consequence of the bank receiving state aid. Even at Bristol & West, where ownership by the troubled Bank of Ireland nearly led to a total loss, a campaign by shareholders managed to beat off attempts to nullify their investments. 's preference share price has now recovered from a low of less than 40p to an above-par 108p.

Financial companies are now likely to start redeeming their preferred shares. The advent of contingent convertibles, otherwise known as enhanced capital notes, into which many large issues in preference shares were switched in 2009, may be the main future hybrid capital source of tier-one capital for banks looking to strengthen their balance sheets. We may see the stock of these interesting fixed-income opportunities dwindle, but holders may get the opportunity for profitable exits.

What is a preference share?

A preference share is an ordinary share-bond hybrid. It takes precedence over (is "preferred to") an ordinary share when a company is wound up, but comes behind all forms of company debt, including debentures, loan notes and bank debt.

It also stands ahead of an ordinary share for dividend payment, so no ordinary dividend can be paid until preferred holders have been reimbursed. However, there is no recourse to the company if a dividend isn't paid, as there is when conventional debt payments are withheld. You cannot wind up a company for failure to pay a preferred dividend, which is one reason why preferred shares rank as tier-one capital for banks. Still, with many preference shares being cumulative, solvent companies have to make payments up at some point.

Preferred shares pay dividends twice a year and, unlike bonds, have an ex-dividend and pay date. Also unlike most bonds, payments are made net of basic-rate tax. This is a significant disadvantage for those using an ISA or SIPP, where gross income from bonds can be protected. Most preference shares are undated, but a few have a final redemption date. As with ordinary shares, buyers of UK-listed preference shares pay 0.5% stamp duty.