Why I'd like to invest in Anpario shares

28th April 2017 16:34

by Richard Beddard from interactive investor

Share on

Despite seeing potential in this AIM share, companies analyst Richard Beddard says they're not cheap. Will he buy them?

Richard, I need to talk to you about . I've seen the potential in this company for a while, but I'm unconvinced by its progress. Perhaps I'm being too harsh...

Come on...Not another new name. When are you actually going to, you know, buy a share?

I know, I know. I'm mulling over , , and *, and now I'm looking at Anpario. I promise to stop procrastinating soon, but it's tricky. I don't have enough cash in the Share Sleuth portfolio**, so I must be confident not only that a share is a good long-term investment, but also that it's substantially better than the worst share I already own.

You'd better make your mind up, as an investor you live or die by your decisions.

You're dead right about that, but it's better to get a few decisions right than lots of decisions wrong!

OK, Anpario. Name not particularly helpful. What does it do?

Actually the name is a compound of 'animal' and 'pario', which means to create, or give birth to, in Latin. It makes natural additives for animal feeds that improve the health of poultry, pigs, cows, and fish to make them more productive. For example, acidifiers kill pathogens like salmonella in the animal gut, toxin binders make mould and other contaminants in animal feed indigestible, and enzymes improve digestion.

Go on then... why are Anpario feed additives any better than anyone else's?

Good question. First off, they're not antibiotics. The use of antibiotics in animals bred for human consumption is believed to promote antibody resistance, reducing the efficacy of antibodies in treating human disease. They've been banned as growth promoters in the EU since 2005 and regulations were tightened in the US recently, but bans are tricky to enforce because vets are still allowed to treat sick animals with antibiotics and some aren't above prescribing low doses to keep animals healthy.

Nevertheless, food producers are using alternatives as public and regulatory pressure builds. In the US consumers are demanding antibiotic free meat, pushing companies like McDonald's and KFC into ever more restrictive policies on antibiotic use.

They're not formaldehyde either, a cheap and effective method of cleansing animal feed of salmonella and e coli, that also happens to be carcinogenic.

Oh, and they're not zinc oxide, it's used in pig production to reduce e-coli. The EU is banning that in April.

Sheesh! We've been eating antibiotics, formaldehyde and zinc-oxide? What else are they putting in our food?

Natural additives, as it happens, which is where Anpario comes in. For example, Irish pig farmers are using Genex as a zinc-oxide alternative.

In the natural additive market, winning orders is all about science. Anpario's salespeople encourage customers, major agricultural integrators, and the feed mills and vets who supply them to run trials. It also collaborates with universities with strong reputations in animal nutrition to demonstrate improved 'performance output' in animals. Anpario is working on Genex trials with the University of Manitoba.

Optomega-50 is an Omega 3 supplement. It improves bone strength and fertility in animals, and also the health of humans who consume animal products containing Omega 3. If you buy an egg enriched with Omega 3 in The UK, Anpario says it was probably laid by a hen fed with Optomega-50.

Anpario's formulations aren't patented because that would mean disclosing too much information about them. Instead, it trademarks the brands, and keeps the ingredients and carrier matrices to itself. Carrier matrices ensure the additives are digested slowly and remain effective along the full length of the gut.

Rivals have formulations of their own, though. Alltech and Biomin, both larger firms, dominate the toxin binder market for example. The total global speciality feed additive market is worth many billions of dollars in annual sales, so Anpario, which earned £24 million in the year to December 2016 is very small.

To grow, it must find ways to show customers how well its products work.

Do they work then?

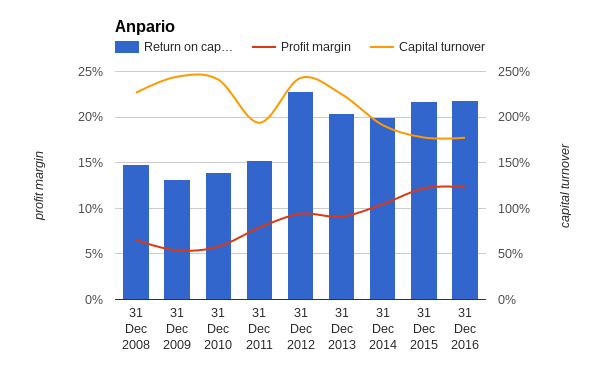

Well, I've seen some of the science and, of course, it's mostly gobbledegook to me. That said, science is happening. I've seen the handful of scientists Anpario employs in its R&D department and we know Anpario's products are valued by existing customers because it's very profitable:

The rise in profit margins and the decline in capital turnover is the result of the acquisitions and subsequently Anpario's focus on its branded additives. In recent years it's sold off a lower margin animal feed business and reduced the amount of contract manufacturing it does, which explains why profit margins have risen but capital turnover has fallen.

I remember now. You visited the company didn't you? Somewhere up the A1. Workshop was it?

Worksop. I'd written an article in 2014 complaining that although Anpario could be growing profitably and reliably, the company didn't really tell me enough in its annual reports to be confident growth would be sustained. The chief executive, David Bullen, invited me to Anpario to fill in the gaps***. Bullen impressed me. Here he is showing me around the factory:

And while I didn't buy the shares because they seemed fully valued, I kept them on my watchlist. That hasn't changed, at 310p the shares are still quite pricey. They value the enterprise at just over £60 million, or 21 times adjusted profit in the full-year to December 2016. And Bullen's gone...

He's gone? Was he pushed, or did he bolt?

He left in January last year, to pursue other interests. It doesn't sound like he left under a cloud, although the board may have been concerned about revenue growth, or rather, the lack of it. Since I visited Anpario that's what's been bothering me.

Bullen's been replaced by Richard Edwards, a former CEO, who kick-started Anpario in 2006 when as chief executive of a loss-making firm developing pheromones to encourage fish to feed, he acquired Agil, which produced a range of acidifiers. During Bullen's tenure, Edwards was executive vice-chairman, and remained heavily involved in the acquisitions of Optivite in 2011 and Meriden in 2012 that gave Anpario a factory and extended the additive range, and its expansion in the USA.

So what's Edwards like?

You know I'm a terrible judge of character? I've never met an unimpressive chief executive. I like to think that's because I focus on good companies, but it's also because you don't get to be chief executive unless you can impress people. I haven't met Edwards, but he's experienced, obviously, and he answers a straight question with a straight answer.

Let's talk revenue then, if that's a potential problem we might as well put it to bed early.

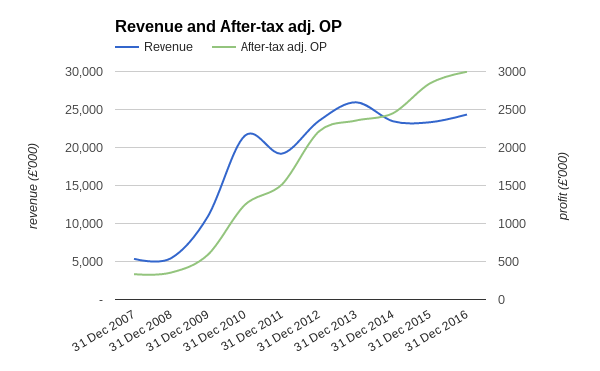

Take a look at this:

During the years Anpario was acquiring companies, revenue and profit grew strongly, as you might expect. Since 2012, the rate of profit growth has slowed, as you might also expect since it's not turbocharged by acquisitions any more, but revenue has flatlined.

That's not what I would expect from a small company seeking to sell more products that are in demand in a gigantic market, although the loss of lower margin feed and contract manufacturing business in recent years may have masked a small increase in revenue in the additives business that remains.

Well that is that surely? Anpario's valued like a growth company, but it doesn't really walk and talk like one. Move on.

Not so fast, hotshot. I am not one to get carried away by a couple of years of strong growth, and neither am I one to be put off by the lack of it. You know what they say about past performance. Well, it's true about companies as well as investors.

Past performance is no indicator of future performance. It takes a long time to establish a product, Anpario acquired many of its products in the last seven years, it has to register them in numerous countries and sort out the distribution. If Anpario has valuable products and we're patient, it should grow.

You mean... when there's a catalyst?

Don't use the 'c' word. Of course there will be catalysts, it's spotting them before they become obvious in hindsight that is tricky. If Anpario is to metamorphose into a genuine growth stock, it will be because of initiatives the company has already started, some of them years ago.

Edwards' resumption may have energised Anpario's growth strategy, though. The company's rationalised its disparate brands under the Anpario name, and it's recruiting more salespeople and account managers in its most important territories. Having opened offices in the biggest meat producing countries: China, The USA and Brazil, it acquired its distributor in Australia last year.

Of the big three, Anpario has operated longest in China, where it now earns about 10% of revenue. Edwards is dissatisfied with progress though, and Anpario's China story may explain why it has struggled to grow through distributors.

Large end users prefer to deal with manufacturers directly, Edwards says, because they know more about the products, have more scope to negotiate, and have more working capital to finance supply in the quantities large customers need. Anpario has been targeting those customers directly for a while, but now it's putting more resources into it.

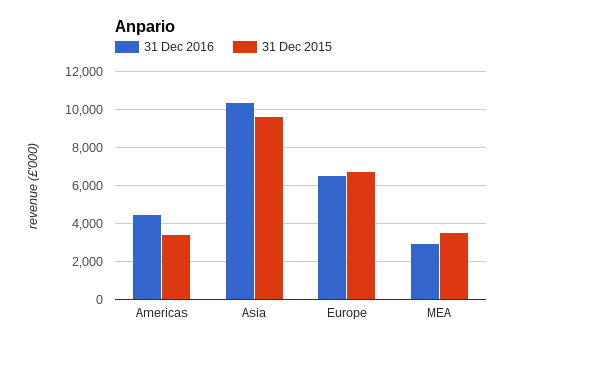

In the segmental report attached to its preliminary results, Anpario made a welcome break from the past by giving more detail about where revenue comes from. The old breakdown did little more than tell us the vast majority of revenue came from abroad (although the company provided more ad-hoc details in the narrative of its annual reports).

War in the Middle East and recession in Brazil hit revenue in 2016, but whether it's evident in the company's performance or not, I don't like taking growth for granted and Anpario must grow to be worth the current share price.

That sounds a bit like a decision, Richard.

Does it? It shouldn't. I'm right on the fence!

I would like to invest in Anpario. It's resoundingly profitable and, though underlying revenue from additives has only been growing slowly, I believe the company will in time build the distribution network it needs to sell more. I understand the firm better than I used to.

It's just the bleedin' valuation I can't reconcile, and I'm trying to be less dogmatic about valuations...

---

*See Judges Scientific: A miniaturised Berkshire Hathaway,Portmeirion in three-way scrap for place on this 'buy list', and Why Howdens is on this 'buy list'

**See the Share Sleuth portfolio on Money Observer

***See Meet the chief: An afternoon at Anpario

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.