Who now thinks Barclays shares are a better bet than Lloyds?

11th May 2017 13:07

by David Brenchley from interactive investor

Share on

Like most in a sector that our technical analyst Alistair Strang jokes is full of "clowns", shareholders have endured a rough time. Above £7 in 2007, the shares are now worth over two-thirds less and performance remains erratic.

There have been signs of green shoots over the course of the past year, not least after forecast-beating full-year results in February when the shares rallied to 244p. After a gentle slide since, first-quarter results last month accelerated the decline, and they're down another 1.5% Thursday.

Indeed, 240p seems an important level - a "glass ceiling" as Strang put it a couple of months back. It's tried and failed to breach that level no fewer than four times since December.

Still, it's in a better position than many of its UK retail bank counterparts - and Investec analyst Ian Gordon reckons a re-rating is on the cards in the medium term, pencilling a rise to 245p as his target. It's been 18 months since the shares made a move like that stick.

While Gordon acknowledges that Barclays' turnaround is neither imminent nor particularly dramatic - return on tangible equity of more than 10% is very much a 2020 aspiration - the firm stands out as one of few residual value opportunities in the sector.

On 0.7 times first-quarter 2017 tangible net asset value (tNAV), "it is (rather clearly) the cheapest UK bank in our coverage", he explained. "We think this overly discounts a return profile which is comparable with 'premium-rated' peers [such as] (hold), (hold) and (sell)."

The turnaround Barclays is trying to push through, led by CEO Jes Staley, has certainly begun in earnest. In particular, a notably strengthened capital position continues to confound the sceptics.

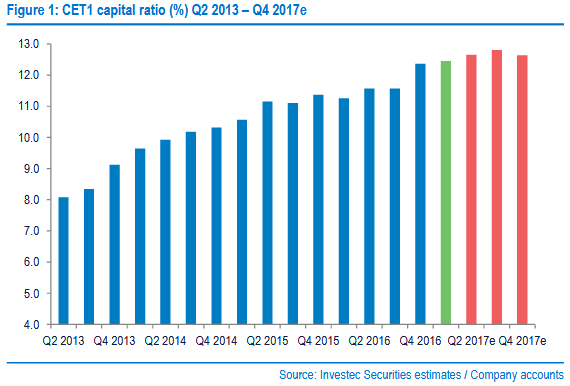

Its core equity tier 1 (CET1) ratio stood at a healthy 12.5% in Q1 2017. Since then, the disposal of its Egypt business added an extra 10 basis points (bps). Put in context, its CET1 ratio back in the second quarter of 2013 was 8.1% - a 50%-plus improvement in the space of four years.

While it incurred a CET1 hit in Q1 by calling its $1.375 billion (£1 billion) 7.1% preference shares in February, and will do similar to its remaining $2.65 billion 8.125% prefs sooner rather than later, further improvements in its capital efficiency should feed through over the next few years.

Offloading its stake in Barclays Africa - an attempt is ongoing - will give its CET1 a 0.75% uplift. Meanwhile, unlike some Gordon sees the pension drag to the ratio as a "receding headwind". Currently it represents a 9bps drag, but that falls to 5bps in Q2.

All in all, its valuation looks attractive to Gordon - so much so he is compelled to rate it as his preferred UK large-cap bank, replacing .

Strang also prefers Barclays to its two retail bank competitors, as he has pointed out in recent weeks, "simply due to the strength with which it recovered from the shambles back in 2009". His previous update mentioned £3 - but that seems some way off on the horizon for now.

Interestingly, in a note also sent to clients Thursday after released its Q1 interim management statement, Gordon says this is "by far the 'cheapest' UK bank in our coverage", though measured on a different metric to Barclays - trading on 8.1 times forecast 2017 earnings per share (EPS).

Gordon, a champion of so-called 'challenger banks' over recent years, reckons there's still plenty more to come from Aldermore, despite an impressive 150% rally since July lows of 102p. He calls the shares up to 290p, which would extend that recovery to 184% - certainly an interesting alternative option to Barclays, anyway.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.