Consistent fund all-stars - Premier League 2014 annual review

12th November 2014 09:45

by Rebecca Jones from interactive investor

Share on

It's been an eventful year for Money Observer's Premier League. Only two funds from our last annual review - and - have made it through to this year's line-up, demonstrating how diffcult it can be for fund managers to maintain strong outperformance.

The Premier League highlights and celebrates the best-performing open-ended funds and managers from each of the Investment Management Association's (IMA's) 15 most-popular fund sectors.

To gain a place in the league, a fund ideally must have delivered first-quartile returns within its sector in each of the past three years, had the same manager at the helm throughout that period, and have more than £10 million of assets under management. In each of our quarterly reviews, the fund's performance over the most recent year must also be in the first or second quartile for it to retain its place.

It's tough to be included

Funds that meet all of the above criteria may still not make the league if they are soft- or hard-closed to new investors, impose large initial charges, are not widely available to private investors, or are too niche to represent their sector.

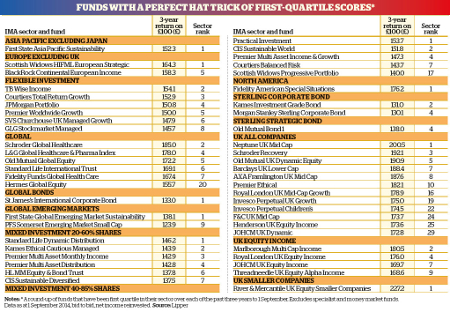

The table below (click to enlarge) contains some funds that were excluded this year on these grounds, despite very strong performance.

The nature of our "point-in-time" analysis means that very worthy funds may miss out if they have perhaps suffered a poor quarter or two within our catchment period.

For example, this year narrowly missed out due to a poor few months in 2012, despite achieving top-quartile performance over the past two years.

Furthermore, as the survival of only two funds from last year's original line-up proves, there are no guarantees that the relatively strong, consistent performance in the league is repeatable, although it is arguably as good a place as any other to identify current and future stars.

This year we have made a slight tweak to the league's formation, excluding the targeted absolute return sector and reintroducing the global bonds sector.

We sacrificed the targeted absolute return sector due to the wide variety of regions and asset classes it represents, which we did not feel lent itself to fair comparison.

We also do not include the mixed investment 0-35% shares or global equity income sectors because of the relatively small number of funds within each.

The global bonds sector has reappeared because the creation of a separate global emerging market bond sector in January removed the funds whose natural volatility was skewing the overall global bonds average.

*To view our consistent Premier League stars, and for a snapshot of how they have performed over the past three years, click through using the links below.

Browse Money Observer's Nov 2014 Premier League review