Why this pioneering AIM stock is "a screaming add"

24th August 2017 15:39

by Richard Beddard from interactive investor

Share on

Big news propels a number of shares into the Decision Engine's buy-zone, as others tumble down the rankings.

A semblance of order

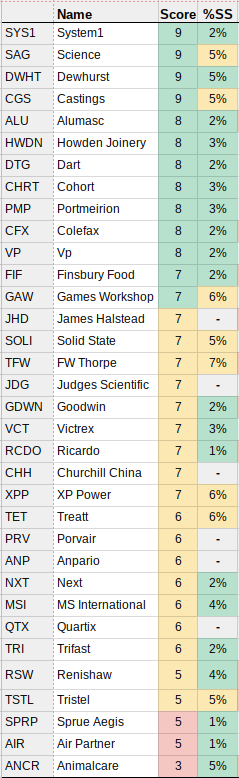

The Decision Engine compares apples and oranges, or, more precisely, market research agencies to kitchen suppliers and the many other kinds of business I follow.

It somewhat subjectively measures how closely each share meets five criteria, characteristics of good long-term investments.

The most highly rated businesses are easy to understand; resilient and adaptable; profitable through thick and thin; and managed in the long-term interests of all shareholders.

I score each of these 'soft' characteristics on a three-point scale from zero to two.

A good long-term investment should also be reasonably priced. The Decision Engine calculates the current market valuation of the enterprise and scores it on a scale from -2 to +2.

There are five criteria in total, so each share can score a maximum of 10. The decision engine ranks the shares by their scores.

I use the Decision Engine to help me manage the Share Sleuth model portfolio. The right hand column shows the proportion of the portfolio invested in each share.

Holdings worth more than 5% of the portfolio are highlighted in orange to remind me I may want to reduce them and put my eggs in other baskets.

Shares that score seven or more out of 10 are 'adds', highlighted in green in the 'score' column. I may add these shares, or add more of them, to the portfolio.

Shares that score five or less out of 10 are 'ejects', highlighted in red. I'm likely to dispose of them.

Big news

The normal ups and downs companies experience, not performing quite as well as people expect, or somewhat better, deals, contracts, movements in costs and currencies, are mostly noise to me.

I look for news that challenges the scores I have fed into the Decision Engine, news that might change my mind about an investment.

System 1

Behavioural market research firm update on the day of its annual general meeting caught my eye. Not because it warned of a collapse in profitability, but because of what that might reveal about the firm's competitive strength.

The company says it's likely to make very little profit in the first half of its financial year compared to £2.8 million in the corresponding period the previous year, although it estimates profit for the full year will only fall 10-15%.

I'm a fan of System1. As a pioneer in behavioural marketing, it has developed techniques and databases that should enable it to make better predictions than much of its rivals who are not specialists and newer to the game.

The company's lost profitability for two reasons. The first is recruitment costs as it seeks to expand in the US, already its biggest market.

The second reason is more unsettling. Demand for innovation projects has fallen, and System1 says the market is more competitive.

System1 tests innovations (concepts) using predictive markets, the slower growing of two behavioural methods that have earned the firm big and increasing profits in recent years.

The admission of competitive pressure may indicate the product is less superior than I realised, and if that's true of one product it could also be true of System1's other flagship product, advertisement testing.

I only give System1 half marks for resilience and adaptability. I'm not sure about resilience - market research is going through a period of rapid disruption. But, as one of the disruptors, System1's certainly adaptable.

The company is constantly innovating. It plans to launch a revamped version of predictive markets later in the year and it recently launched an advertising agency that uses its ad-testing capabilities to develop better advertising.

These initiatives may not prosper, but System1 has a good record of turning its own concepts into highly profitable businesses.

Since the firm scores a perfect 8/8 against the other four criteria, it's a screaming 'add' now the price has dropped almost 50% from its previous high.

XP Power

Power adapter supplier half-year results exceeded already fairly high expectations, an event that might only warrant a footnote were it not for the fact that the Decision Engine ranks it a hold. How can it rank such a successful company so?

XP adapters are embedded in industrial and medical equipment. Over the last decade it has found many ways to earn more profit, principally by designing smaller, more efficient products that are easy to fit into equipment, and manufacturing them in new factories in China and, now labour costs are rising there, in Vietnam.

Not only has it made good strategic decisions that have won it an increasing share of the business of a large number of blue-chip customers, this year its markets are booming.

Revenue from industrial customers rose 19% and revenue from companies that manufacture healthcare equipment rose 36%, but it was the manufacturers of machines that make semiconductors that led the way. Revenue from them increased 58%.

Demand for equipment for factories is cyclical. Manufacturers invest when orders are high and reduce investment when order books shrink.

The semiconductor industry is notoriously cyclical and currently gearing up for the next generation of iPhone. It won't always be this way.

I think XP is a very good business, likely to remain profitable even in lean times. But there's a danger investors expectations are too high.

I give XP an almost-perfect score. The Decision Engine is more ambivalent about its valuation, which is why it isn't an 'add'.

Howdens

Kitchen supplier is also following a rather brilliant strategy. It focuses resolutely on the requirements of one type of customer, small builders, of which there are many hundreds of thousands.

The great thing about selling to builders is that, because the service is good, they are repeat customers; unlike individuals, who buy kitchens very infrequently.

The big news from Howdens, though, is the architect of the strategy, chief executive Matthew Ingle, is retiring and his replacement is an outsider.

No doubt the board has carefully selected Andrew Livingston of Screwfix as Ingle's successor, and, in rating Howdens so highly, I expect him to recognise the value of the finely honed business model he will operate.

Results, and more results

Since the last Decision Engine update in early July, I've reviewed four companies because they've published annual reports.

The biggest surprise was from , and it was a pleasant one. The fantasy toy soldier supplier and publisher was twice as profitable in its most recent financial year as it was previously. And, by increasing revenue convincingly, it, perhaps, decisively broke with the past.

My re-evaluation has just propelled it into the Decision Engine's buy-zone despite a sharp rise in the share price that, other things being equal, would have dragged it lower.

My enthusiasm for , the charter broker that is diversifying into an air services company, has diminished somewhat as I appreciate the extent of its ambition and how much it has to do to achieve it.

, a manufacturer of parts for diesel engines mostly in heavy goods vehicles, still makes the grade despite apparently facing monumental challenges.

Though diesel is fast becoming a pariah fuel, and Brexit may roughen relations with Castings' predominantly European customers, it remains in many ways an exemplary business.

, which makes naval canon, petrol station forecourts and arms for fork-lift trucks, hangs on as a hold despite many misgivings, but maybe not for long.

Work in progress

If you're waiting for commentary on , and , I apologise - it's coming soon. These companies published annual reports, but I'm behind in my analysis because I've been on holiday.

The figures used by the Decision Engine are up to date, though, and, having skim-read the commentary, I doubt my judgements will change much.

, and have published preliminary results, but I've yet to plug them in. That's because the Decision Engine is reliant on information routinely left out of the preliminaries but included in annual reports, which are usually published later.

I wait for the annual report before reappraising a share, partly to get the full story, and partly because I don't want to rush to judgement with everyone else.

Being late doesn't usually matter. The Decision Engine is not finely tuned to the latest set of results. It's a long-term tool designed to measure the enduring factors that suggest a company will profit for many years.

The valuations it calculates are usually based on averages calculated over many years, and adding one more year rarely changes much.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.